open-end credit meaning and example

A line of credit generally arranged before the funds are actually required provides flexibility for the customer in that it ensures the ability to meet short-term cash needs as they arise. Refers to credit that you can keep adding on to as long as you continue meeting the terms of the creditor agreement.

Letter Of Credit Lc Meaning Process Role In International Trade Drip Capital

Charge account credit account open account credit extended by a business to a customer charge card charge plate credit card plastic a.

. Any periodic rate that may be applied expressed as an annual percentage rate using that term or the abbreviation APR. An arrangement for borrowing from a bank where money can be taken and paid back up to an agreed limit and interest is charged only on the amount that remains which may be paid off at any time within the period of the loan. At the end of the term defined by the lender the lender will send an invoice or bill to the borrower.

The maximum borrowing power granted to a person from a financial institution. Open-ended accounts have pre-approved credit limits that allow you to carry an outstanding revolving balance at any given time. Ii The creditor may impose a finance charge from time to time on an outstanding unpaid balance.

And iii the amount of credit that may be extended to the consumer during the term of the plan up to any. Credit card accounts home equity lines of credit HELOC and debit cards are all common examples of open-end credit though some like the. Charge account credit revolving credit.

Common examples of open end credit include credit cards or. Charge account credit revolving credit Types. Definition and Example of an Open-Ended Account.

Summary An open credit is a financial arrangement between a lender and a borrower that allows the latter to access credit repeatedly up to a specific maximum limit. Open-end credit is not restricted to a specific use. 2262 a 20 Open-end credit means consumer credit extended by a creditor under a plan in which.

Open-End Unsecured An unsecured open-end loan is a line of credit thats not attached to a piece of collateral. 1 n a consumer credit line that can be used up to a certain limit or paid down at any time Synonyms. Like a traditional mortgage loan it gives the borrower enough cash to purchase a home.

Your browser doesnt support HTML5 audio. Triggered Terms 102616 b. You must pay a low minimum balance by the due date.

Ii the creditor may impose a finance charge from time to time on an outstanding unpaid balance. In the consumer market home equity loans are an example of an open-end credit which allows homeowners to access funds based on the level of equity in the homes. Iii The amount of credit that may be extended to the consumer during the term of the plan up.

Charge account credit account open account - credit extended by a business to a customer. For example there are separate rules for closed-end credit such as automobile or home mortgage loans and for open-end credit such as credit cards or home equity lines of credit. An arrangement for borrowing from a bank where money can be taken and paid back up to an agreed.

Open end credit. The borrower is able to withdraw indefinitely until the limit is met. The regulation carefully defines open-end credit as consumer credit extended under a plan in which i the creditor reasonably contemplates repeated transactions.

With open-end credit you receive a credit line with a limit that you can draw from as needed only paying interest on what you borrow. Your browser doesnt support HTML5 audio. The borrower can make frequent and repeated transactions up to that credit limit.

An open-end mortgage is a unique type of home loan in that the borrower has the opportunity to use the funds from the loan as needed even after they purchase the property. Definition and Examples of an Open-End Mortgage. Also called bank line credit line.

The term does not include negotiated advances under an open end real estate mortgage or letter of credit. Closed-end credit on the other hand is a. A credit arrangement in which a financial institution agrees to lend money to a customer up to a specified limit.

I The creditor reasonably contemplates repeated transactions. Open-end credit is a type of credit in which the lender extends credit to a borrower up to a certain credit limit. 17 Open end credit means credit extended under a plan in which a creditor may permit an applicant to make purchases or obtain loans from time to time directly from the creditor or indirectly by use of a credit card check or other device.

Line of credit denotes a limit of credit extended by a bank to a customer who can avail himself or herself of its full extent in dealing with the bank but cannot exceed this limit. Open-end credit - a consumer credit line that can be used up to a certain limit or paid down at any time. Common examples of open-end credit are credit cards and lines of credit.

If the plan provides for a variable rate that fact must be disclosed. With open end credit you can continue making purchases and paying for them in the future as long as you continue making at least the minimum payment each month. Membership or Participation Fees.

Consumer credit - a line of credit extended for personal or household use. Noun C or U BANKING FINANCE uk. An open-end loan also sometimes referred to as open-end credit is a form of borrowing that can be used up to a certain limit before it must be repaid.

Examples of open-end loans are credit cards and a home equity line of credit or HELOC. It most frequently covers a series of transactions in which case. Transactions that exceed the pre-approved limit are typically declined and not processed.

Open-end loans are also sometimes referred to as revolving credit.

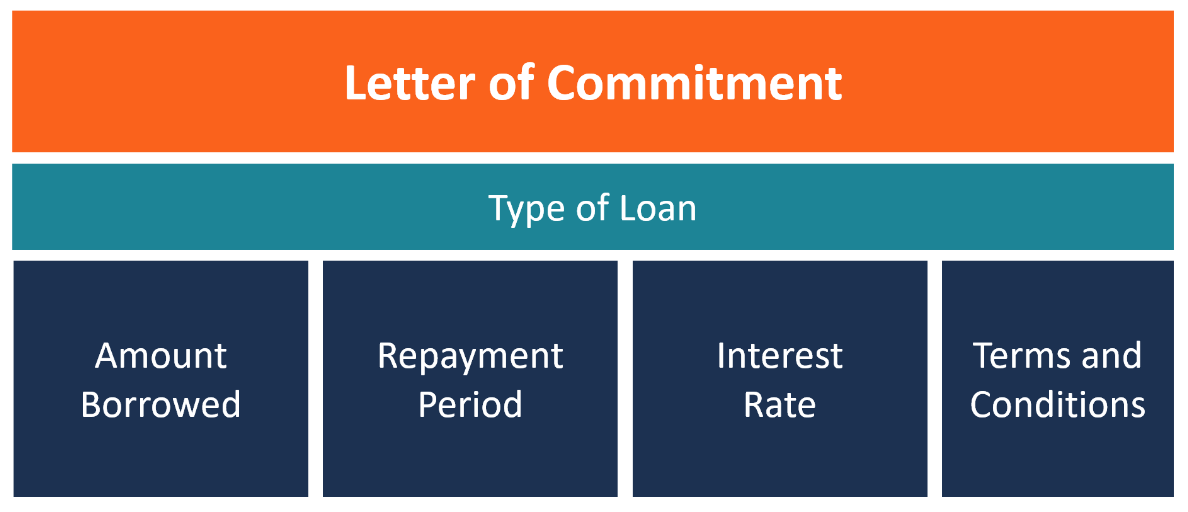

Letter Of Commitment Overview Example And Contents

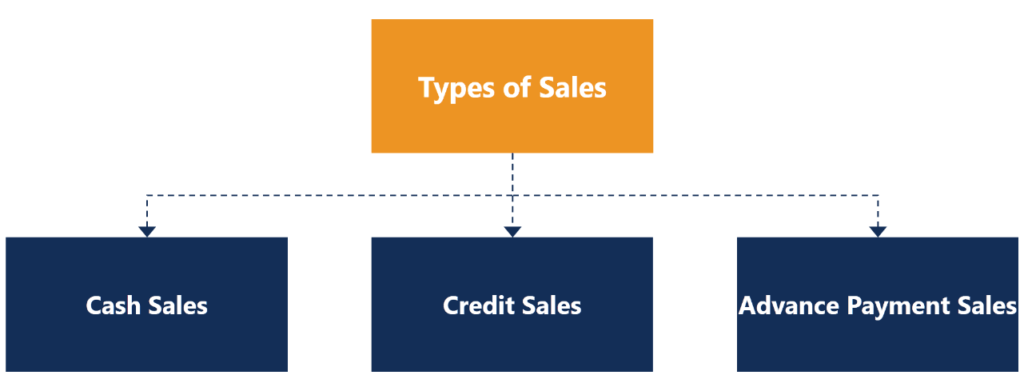

Credit Sales How To Record A Credit Sale With Credit Terms

Free Terms And Conditions Template And Examples Termly

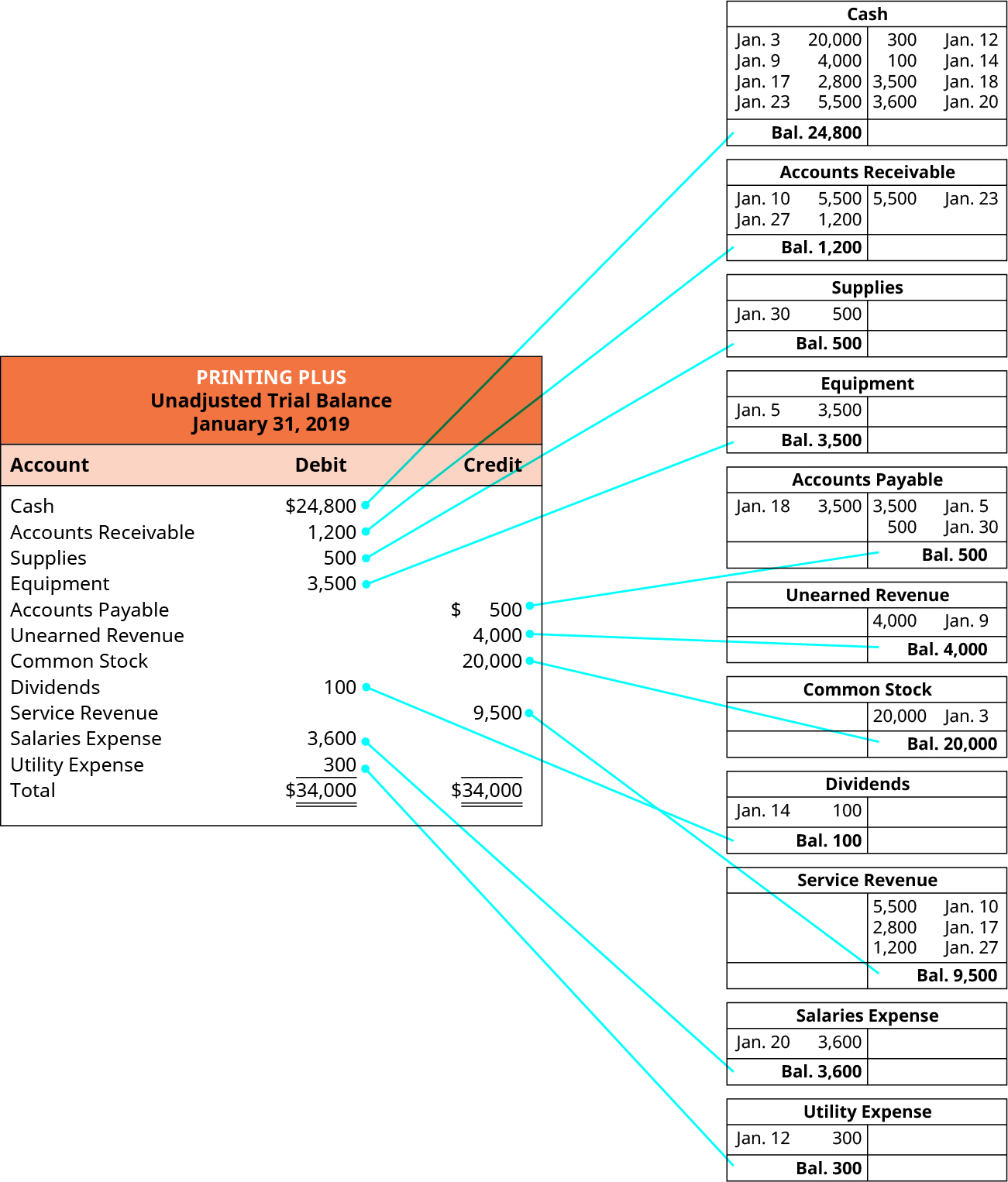

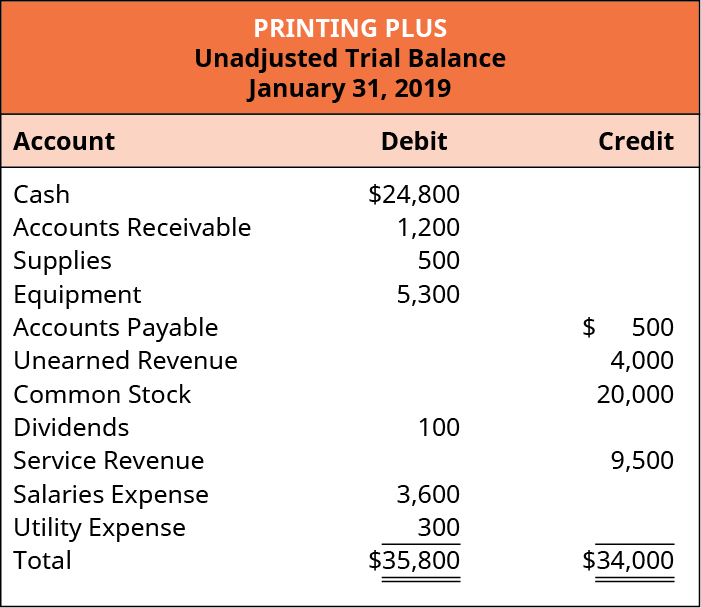

Prepare A Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Letter Of Credit Lc Meaning Process Role In International Trade Drip Capital

Letter Of Credit Lc Meaning Process Role In International Trade Drip Capital

Understanding Different Types Of Credit Nextadvisor With Time

What Is A Good Credit Score Forbes Advisor

Prepare A Trial Balance Principles Of Accounting Volume 1 Financial Accounting

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

How To Read A Credit Card Statement Discover

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

What Is A Credit Utilization Rate Experian

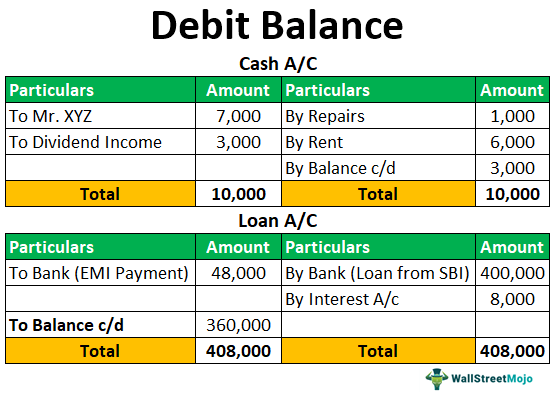

Debit Balance Meaning Example Difference Between Debit And Credit Balance

How To Use A Credit Card Best Practices Explained Valuepenguin

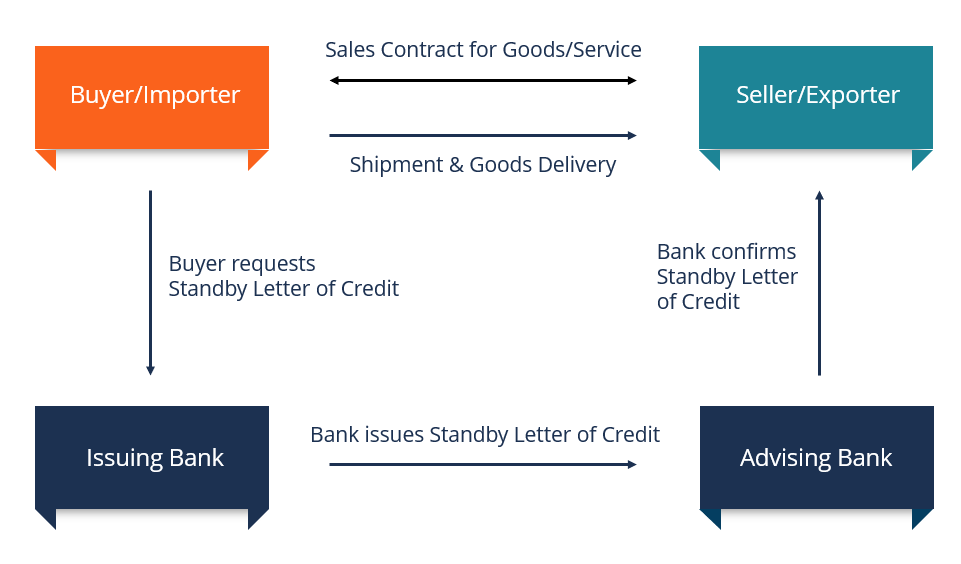

Standby Letter Of Credit Sblc Overview How It Works Types

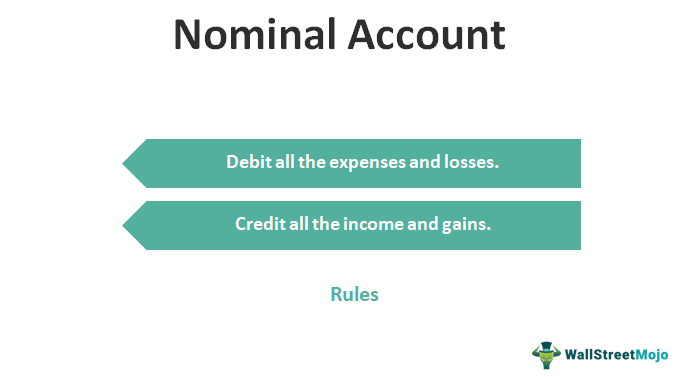

Nominal Account Rules Examples List Nominal Vs Real Account

Sales Journal Entry Cash And Credit Entries For Both Goods And Services

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)